Global OS Market Share 2025: Key Stats, Trends, and Insights for Mobile and Desktop

Operating systems don’t always get the spotlight, but they’re the quiet workhorses behind nearly everything we do, from phone notifications to spreadsheets and Zoom calls. And in 2025, we’re seeing a lot of shifts in the OS market.

With work, communication, and content creation happening across more platforms and devices than ever before, knowing which OS leads and why can help us understand how people use tech, how companies make decisions, and how global access to tech and digital tools is changing.

We’re breaking things down into two categories: Mobile OS (like Android and iOS) and Desktop OS (think Windows, macOS, Linux, and ChromeOS). We’re using the latest data, along with charts and real world context, to deliver useful insights and see what’s really driving these shifts.

So why split them up? Because mobile and desktop don’t always follow the same rules. For instance, mobile OS trends reflect consumer habits and app ecosystems. Meanwhile, desktop OS trends are sometimes shaped by business needs and hardware cycles.

Understanding both sides of the story helps give us a clearer view of the evolving tech landscape, whether you’re managing procurement or just keeping tabs on what’s coming next.

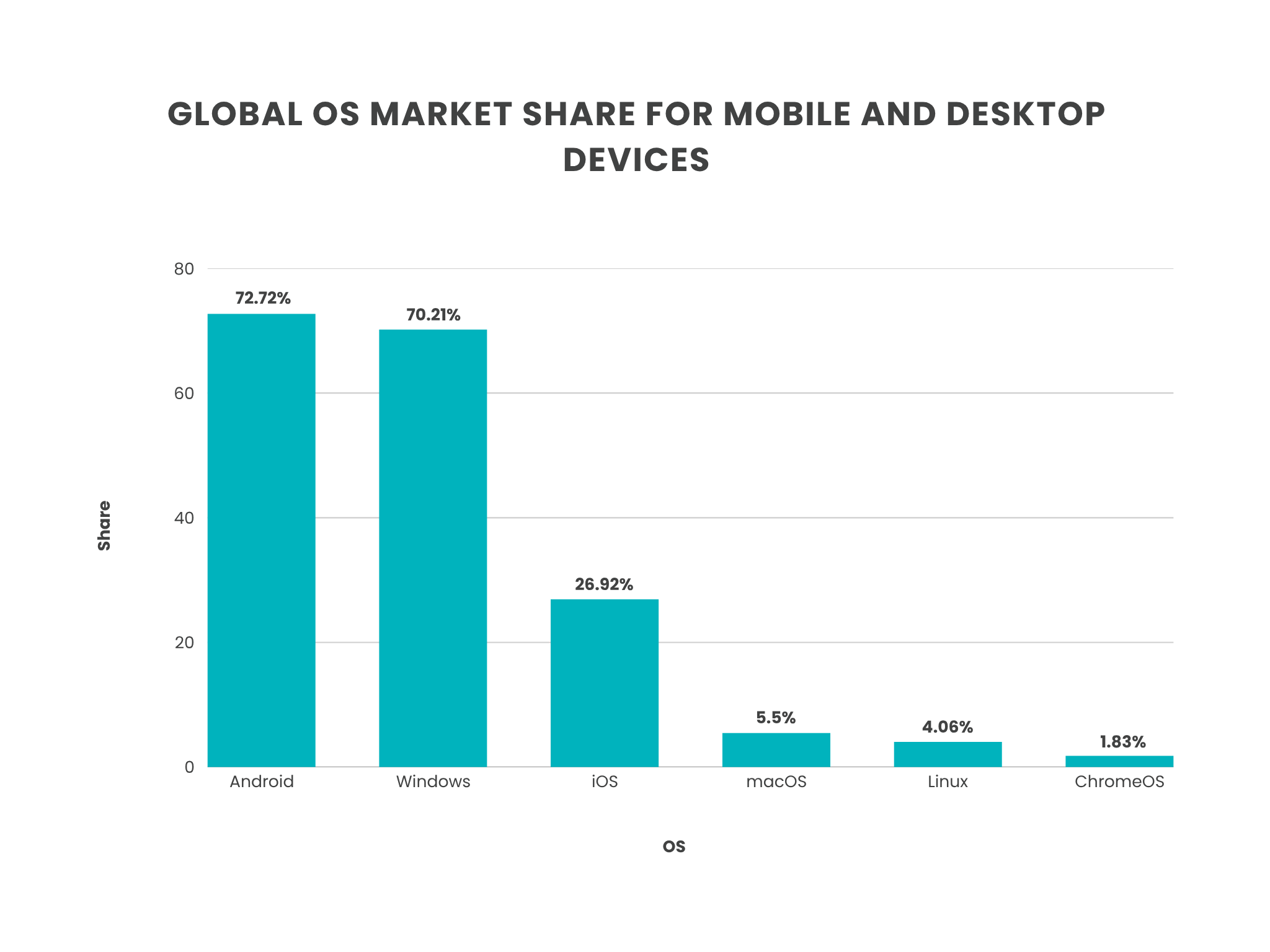

Global operating system market share: 2025 snapshot

StatCounter’s latest aggregated report provides a snapshot of global OS usage across mobile and desktop platforms:

| Platform Market Share (May 2025) | % of Global OS usage |

| Android | 72.72% |

| Windows | 70.21% |

| iOS | 26.92% |

| macOS | 5.5% |

| Linux | 4.06% |

| ChromeOS | 1.83% |

Sources: https://gs.statcounter.com/os-market-share/desktop/worldwide and https://gs.statcounter.com/os-market-share/mobile/worldwide

Compared to May 2024, Android has grown slightly, while Windows has dipped largely due to slowing enterprise upgrades and mobile-first expansion in emerging markets. According to a recent report published in The Register, the adoption of Windows 11 by users is still lagging, even as Windows 10 is nearing its end of life.

But despite the lag, user adoption will likely increase in the coming months. According to experts, we may see an increase in adoption between 0.5% and 1.5% every month leading up to October.

Factors affecting Windows 11 adoption

In a discussion with The Register early this year, Canalys analyst Kieren Jessop shared some theories as to why adoption is lagging for Windows 11. According to Jessop, last year’s Windows 10 market share actually jumped from 58% (October 2024) to 67% (December 2024).

A recent TechRadar article noted that as more businesses finally upgrade their devices, we’ll start to see an uptick in Win11 adoption. According to the article, if this trend continues, it’s also likely that Win10 adoption will start to slow.

This can be attributed to issues regarding hardware compatibility requirements (Windows 11) and requirements by enterprises or public institutions. Another reason? Enterprises downgrading their devices from Win11 to Win10 for their refresh cycles. That’s because, for these organisations, Win10 offers better stability and compatibility with their existing systems, explains Jessop.

macOS and Linux saw marginal gains, reflecting increasing adoption among remote teams and developers. OS market share volatility is increasingly driven by hardware lifecycle decisions and regional connectivity initiatives.

Beyond numbers, the year-over-year comparison underscores a broader shift: personal and workplace computing is moving towards multi-device, multi-OS environments. Understanding the relative market

share and shifts is essential for anyone building cross-platform apps, managing IT procurement, or evaluating compatibility for business systems.

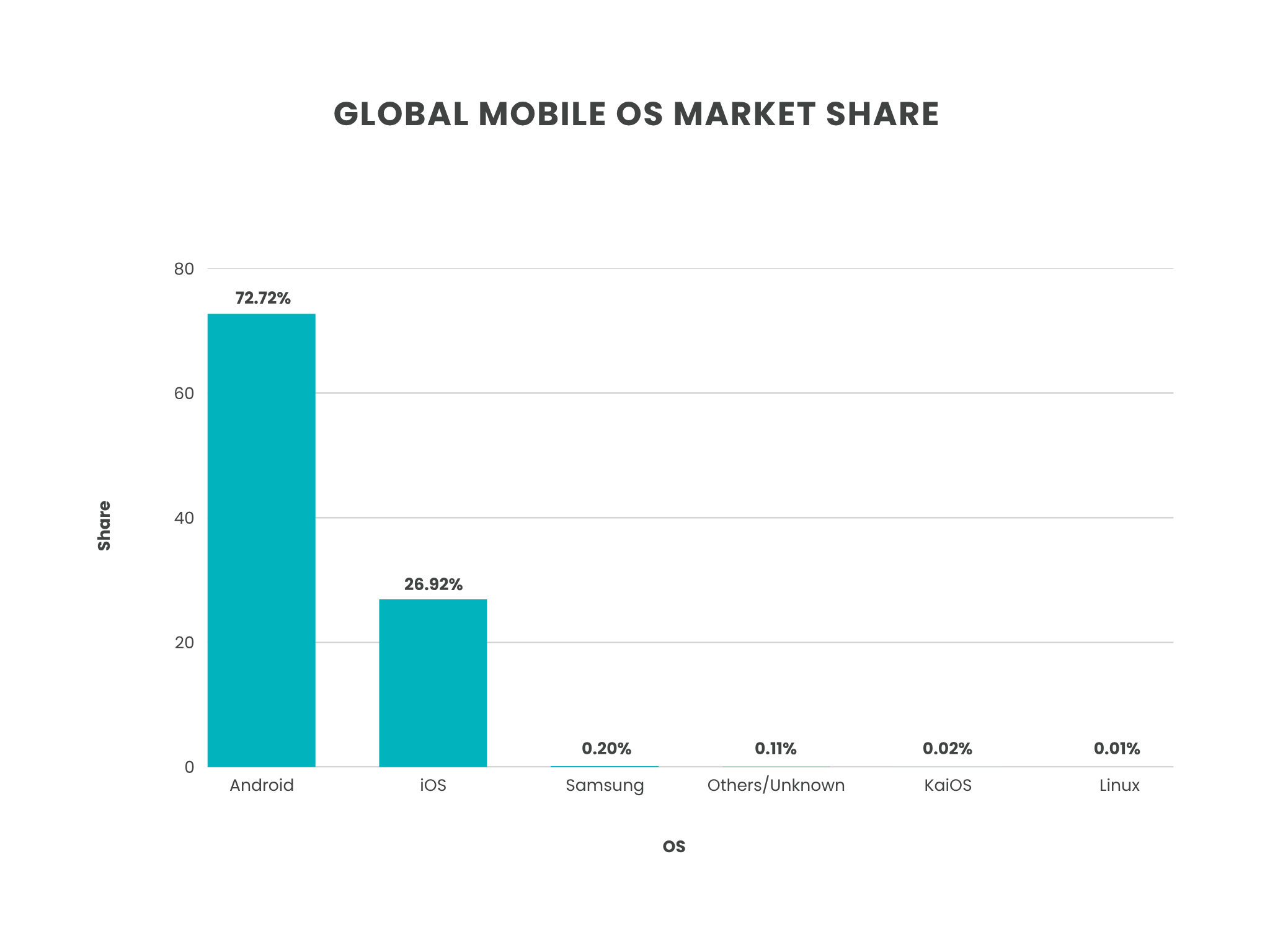

Mobile operating system market share breakdown

As of May 2025, Android leads the global mobile OS market:

| Platform Market Share | % of Global OS share |

| Android | 72.72% |

| iOS | 26.92% |

| Samsung | 0.2% |

| Others/Unknown | 0.11% |

| KaiOS | 0.02% |

| Linux | 0.01% |

Source: https://gs.statcounter.com/os-market-share/mobile/worldwide

Android’s dominance is especially evident in APAC, LATAM, and Africa.

Still, the question remains: Why does Android continue to corner the global mobile operating system market share?

For the most part, it’s an open-source model that lets users customise both their phones and the operating system. This means anyone can view, download, and modify its source code. However, it’s worth noting that just recently, Google will begin to privately develop the Android OS. The good news? Google will continue to publish the source code for new releases.

According to a 2018 World Economic Forum article, another reason is that Google, having bought the platform in 2005, collaborated with some of the world’s leading smartphone brands at that time (Samsung, Sony, and HTC), which then designed their phones around the Android OS.

iOS holds a stronger presence in North America (52.25%) and the United Kingdom (49.92% vs. 49.67% for Android, as of May 2025), likely due to income-based purchasing behaviour. Other potential factors affecting consumers’ decisions to purchase iOS devices include brand loyalty, price, perceived risk or consequences, and product features.

Furthermore, social factors and brand image can influence buyers’ decisions. However, one study suggests that social influences don’t particularly impact the purchase intention of younger consumers.

In addition to economic drivers, Android’s market strength is boosted by its availability on a wide range of devices, from flagship models to ultra-budget handsets from different brands like Samsung, Google Pixel, Motorola, Nothing Phones, and OnePlus.

Developers targeting mobile audiences must remain platform-aware. For instance, app performance and battery optimisation strategies may differ greatly between ecosystems. Additionally, Android fragmentation across manufacturers often results in longer update cycles, which could impact security and app compatibility.

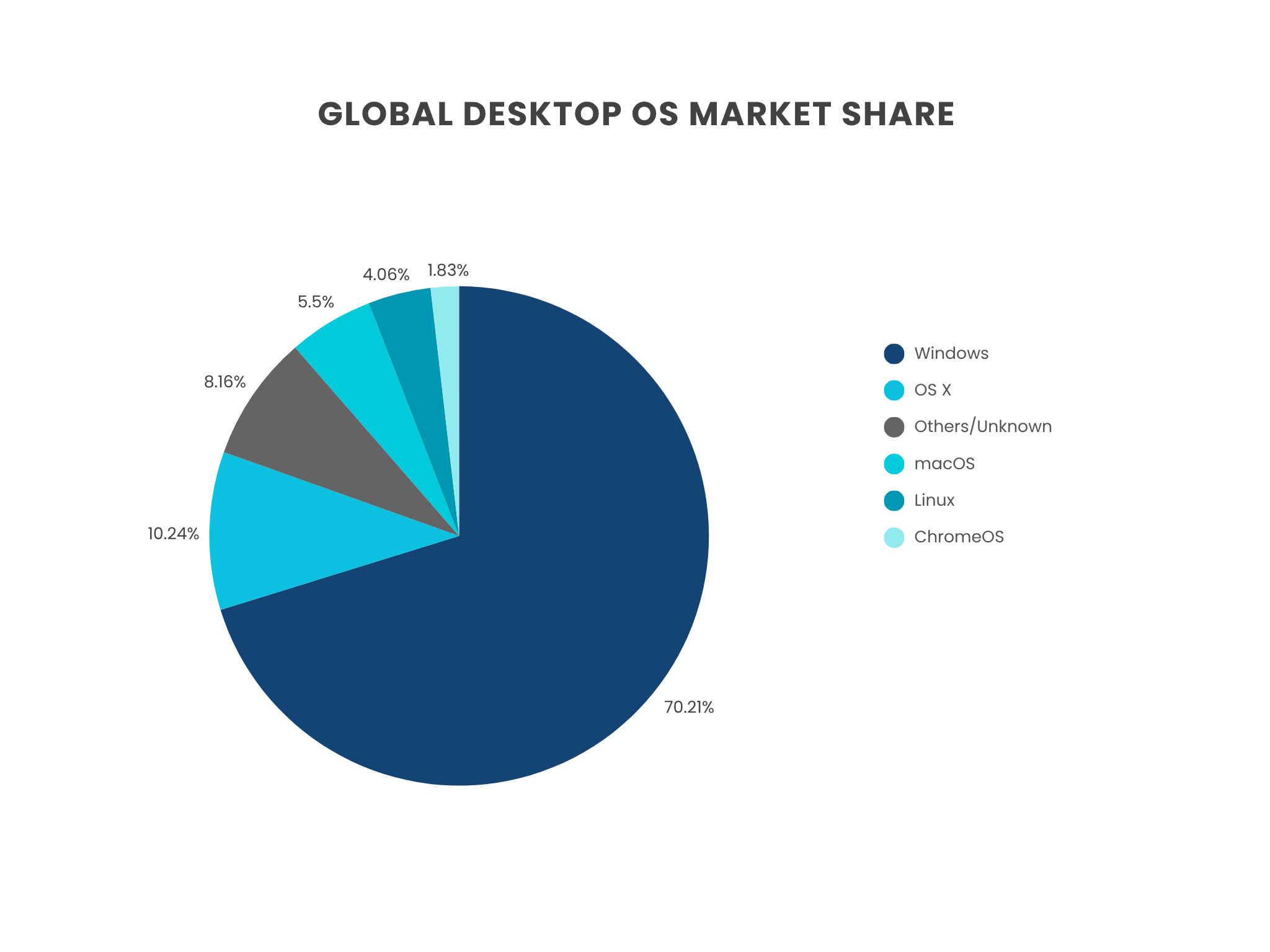

Desktop operating system market share breakdown

Here’s the global desktop OS usage as of May 2025, based on StatCounter data

| Platform Market Share | % of Desktop OS Global Share |

| Windows | 70.21% |

| OS X | 10.24% |

| Others/Unknown | 8.16% |

| macOS | 5.5% |

| KaiOS | 0.02% |

| Linux | 4.06% |

| ChromeOS | 1.83% |

Source: https://gs.statcounter.com/os-market-share/desktop/worldwide

Windows continues to lead in desktop environments, particularly in large organisations that rely on legacy systems and enterprise software compatibility. However, macOS is steadily gaining traction, driven by creative industries, remote workers, and enterprises embracing Bring Your Own Device (BYOD) policies.

While operating systems like Linux and ChromeOS have smaller market shares, they’ve been stable in recent years, according to a Statista report.

Linux remains a niche but influential player, especially in developer environments and server-side applications. Ubuntu, an open-source OS based on Linux, is also growing in popularity because of its improved compatibility (gaming) and subjectively cleaner interface. However, some users remark that it’s less user-friendly compared to other operating systems like Windows, which already has an established ecosystem.

ChromeOS, often associated with educational use and budget devices, has begun making inroads in lightweight enterprises and emerging markets where cloud-first deployments are rising.

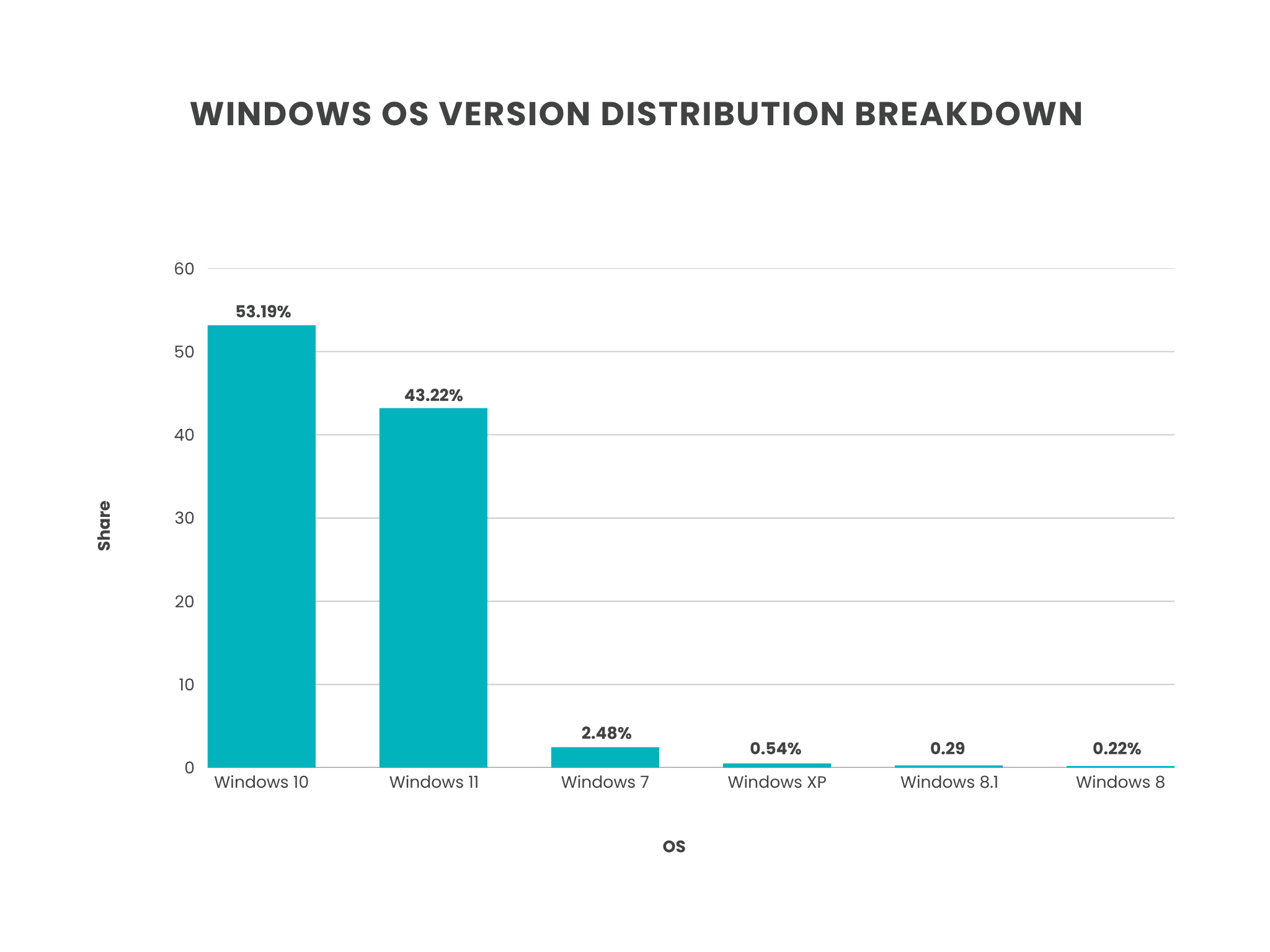

Windows operating system version comparison

Here’s the global desktop OS usage as of May 2025, based on StatCounter data:

| Operating System (May 2025) | % of Global Share |

| Windows 10 | 53.19% |

| Windows 11 | 43.22% |

| Windows 7 | 2.48% |

| Windows XP | 0.54% |

| Windows 8.1 | 0.29% |

| Windows 8 | 0.22% |

Source: https://gs.statcounter.com/os-version-market-share/windows/desktop/worldwide

Figures can vary, depending on your source. As reported by ZDNET, data from the Digital Analytics Program reveals that there is an uptick in Windows 11 usage. From 2024’s 41.6%, Win11 usage jumped to 54.3%. Meanwhile, Win10 usage decreased from 2024’s 58.4% to 45.7% in 2025.

Despite Windows 11 being on the market for over three years, Windows 10 maintains dominance due to:

- Familiarity

- Corporate standardisation and app compatibility

- IT teams delaying migration until Windows 10’s official end-of-life (October 2025)

Enterprises are taking a conservative approach to Windows 11, citing potential compatibility issues with mission-critical software and preferring to align OS transitions with broader hardware refresh cycles. Meanwhile, the residual share of Windows 7, despite support ending in 2020, highlights long-tail adoption in legacy systems, particularly in industrial and government sectors.

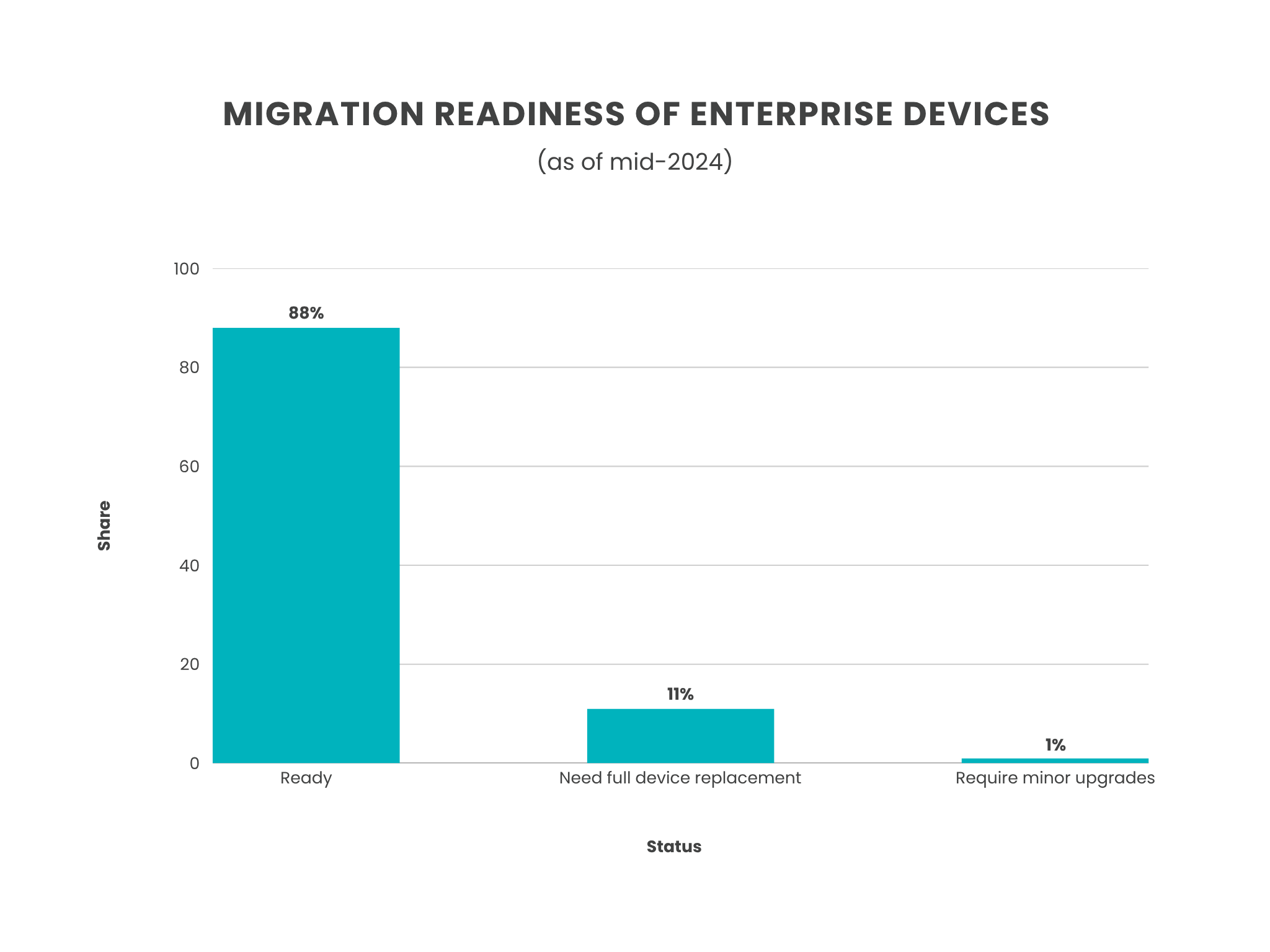

Enterprise OS usage trends and implications

When it comes to OS decisions in big organisations, it’s rarely about what’s new or flashy. It’s about what works reliably, securely, and within budget. Windows still dominates because most corporate apps, workflows, and IT policies are deeply tied to it.

But change is on the horizon.

A ControlUp study, referenced by ITPro, found that 82% of enterprise devices were still on Windows 10 as of mid-2024, despite the Windows 10 end-of-life date being less than two years away at the time the article was written. This suggests organisations are moving cautiously, often syncing their migration timelines with broader hardware refresh cycles to ease the transition.

For devices that haven’t made the switch yet, here’s where they stand in terms of migration readiness:

| % of Migration Readiness | |

| Ready for Windows 11 | 88% |

| Require minor upgrades before migration | 1% |

| Need full device replacement | 11% |

Source: https://www.controlup.com/press/controlup-study-reveals-over-82-of-enterprise-windows endpoint-devices-are-not-yet-running-windows-11/

As ControlUp Field CTO Simon Townsend shared in the article, many organisations are still stuck primarily because they’re “unsure about their environment’s readiness.”

Another major contributor to this delay in migrating to Windows 11 stems from the challenges these organisations faced when upgrading to Windows 10 — a process deemed as “lengthy and disruptive” because of issues with legacy applications and compatibility.

At the same time, sustainability goals are reshaping tech strategies. More IT departments are being asked to do more with less, such as extending device lifecycles, reducing e-waste, and choosing OS solutions that support energy efficiency and long-term support models.

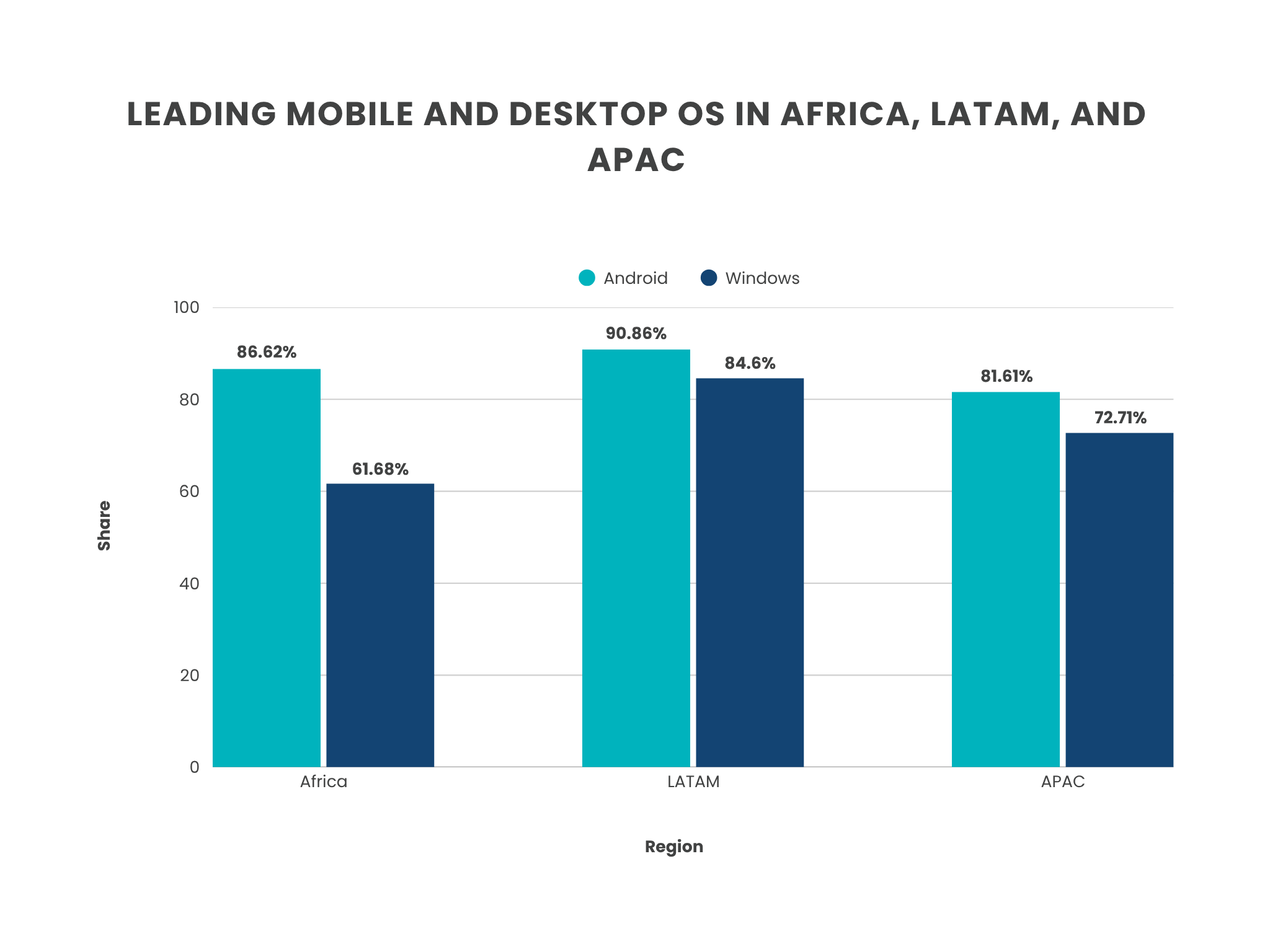

Emerging markets and OS preferences

Emerging markets are often the best places to spot early signals of global tech shifts. In 2025, Android will still be the dominant mobile OS in Africa, Latin America, and much of Asia-Pacific. Its flexibility, affordability, and availability across a wide range of devices make it a no-brainer in these regions.

Region Leading Mobile OS Desktop Trends Africa Android (86.62%) Windows (61.68%)

LATAM Android (90.86%) Windows (84.6%)

APAC Android (81.61%) Windows (72.71%)

Sources: https://gs.statcounter.com/os-market-share/desktop/worldwide and https://gs.statcounter.com/os-market-share/mobile/worldwide

When it comes to desktops, Windows still holds a significant share, but Linux is gaining traction in government and public education sectors, especially in regions like Europe where the following factors are top priorities:

- Digital sovereignty

- Concerns over strategic risks

- Privacy concerns

- Cost savings

For instance, Schleswig-Holstein in Germany and the Danish government have both initiated major Linux transitions. In fact, TechRadar reported that the latter’s Ministry of Digitalisation has laid out plans for a phased migration to Linux and LibreOffice.

In India, Linux’s growing popularity is primarily driven by its cost-effectiveness, which makes it a good option for users looking for affordable computing alternatives. According to Feroz Khan, an IT system administrator, other key drivers of Linux’s growth in emerging markets like India include:

- Educational initiatives

- Government and enterprise adoption

- Strong community support

- Compatibility with a wide range of hardware

Meanwhile, ChromeOS is solidifying its dominance in K–12 education in the U.S. and is steadily gaining ground in NGOS, thanks to its ease of deployment, low cost, and cloud-first design.

For organisations operating across borders, understanding these localised trends is key to planning rollouts, customer support, and even marketing strategies.

Security and OS adoption correlation

Security plays a critical role in operating system adoption decisions.

Older systems like Windows 7 are still being used in some environments. In 2021, a Kaspersky study found that 22% of PC users, including SMBs and very small businesses, still run the Windows 7 OS. Note that mainstream support for this OS ended in January 2020. By May 2025, this figure dipped to just 2.48%, based on data from Statcounter.

The thing is, continued use of outdated operating systems poses serious risks. Without extended support, these systems are vulnerable to cybersecurity threats like data breaches. Plus, you may encounter compatibility issues with newer tech.

With Android’s massive global footprint, it often suffers from inconsistent security update cycles across manufacturers. This can make some devices more vulnerable than others.

Meanwhile, Apple’s tight control over both hardware and software (less susceptible to malware) enables faster and more unified security updates. That’s one reason why iOS often ranks higher in enterprise security assessments.

User behaviour trends: OS switching and updates

Why do people stick with an OS or decide to switch? These factors usually play a big role in influencing OS switching or upgrade decisions:

- App ecosystem

- Device affordability

- User familiarity

- Update fatigue

At any point in the year, over 50% of mobile devices run outdated operating systems, according to Zimperium. This highlights how common it is for users to hold onto a device and its OS until something breaks or an app stops working. That’s particularly true in the mobile space, where Android’s longer tail of legacy versions means developers have to support a wide range of experiences.

On the desktop side, OS upgrades are often delayed not by users, but by IT departments weighing the trade-offs of downtime, retraining, and legacy software compatibility. These concerns are well-justified considering that downtime, for instance, can cost organisations as much as $9,000 per minute, according to Forbes.

For organisations, there’s also a need to consider workforce mobility and how it affects their choice of operating systems. A paper by Zebra Technologies outlines the factors organisations should consider when switching to a new OS, particularly mobile operating systems:

- Requirements from different departments (IT and mobile workforce)

- Applications that may require modifications or data that needs to be transferred • New functionalities and security features relating to data protection and company protocols

Understanding these behaviours helps developers, marketers, and IT leaders better plan around real world adoption curves, not just the headlines.

Future forecasts and expert predictions

Looking ahead, the OS market won’t be dominated by just one player. And that’s a good thing.

Based on current growth rates, Android is likely to hold onto its lead in mobile, while Windows’ share of the desktop market may dip slightly as macOS, Linux, and ChromeOS continue to rise.

While the mobile OS market is projected to grow from USD 54.51 billion in 2025 to USD 74.72 billion by 2030 (Research and Markets), it will likely see shifts in the future brought about by new players, changing consumer demands, and technological advancements.

For example, Huawei’s HarmonyOS is seeing steady growth. As reported by Tech in Asia, HarmonyOS has already surpassed iOS in China for four consecutive quarters (2024). Shares jumped from 16% in 2023 to 19% in 2024.

However, Android remains the leading mobile OS in the country, maintaining a 64% market share (Q4 2024). Meanwhile, the market share for iOS dropped from 20% in 2023 to 17% in 2024.

When it comes to desktop OS, despite Windows commanding a sizeable 80.18% (Q1 2025, StatCounter) in the Chinese PC market, HarmonyOS PC is poised to disrupt the market. As China gears up to boost its self-sufficiency efforts, HarmonyOS could potentially become a viable alternative for Windows in the region.

As of 2024, Reuters reported that more than 900 million devices are running on HarmonyOS.

Takeaways for IT stakeholders

For IT stakeholders, decision-making should increasingly align with long-term strategic priorities. How ESG targets are influencing decisions

There’s also a new layer to the conversation: sustainability. Environmental, social, and governance (ESG) goals are influencing how companies choose their tech.

A 2024 study sponsored by SAP found that more procurement teams are focusing on sustainability. Around 68% of the business leaders surveyed believe their procurement process meets ESG goals, compared to just 21% in 2023.

As stakeholders become more eco-conscious, they’re taking measures to incorporate greener practices into their KPIs, according to a report published by Economist Impact. It’s worth noting that, in the same report, meeting sustainability and ESG goals is one of the top procurement priorities, coming in second place.

Now, this isn’t just for ethics and compliance. It’s also about cutting costs and reducing waste. IT procurement teams are increasingly weighing the long-term impact of their choices. For instance, they’re now prioritising energy-efficient machines, longer refresh cycles, and OS platforms that offer flexibility and support.

Aligning with support lifecycle, regional user needs, and security posture

As OS usage patterns vary more and more between regions, global companies can’t take a one-size-fits all approach. From network infrastructure and device affordability to local user habits, every region has its own context when it comes to tech, such as China with Huawei, for example.

That’s why IT leaders need to look at the full picture. This could mean combining analytics and cybersecurity insights to shape strategies that truly fit their needs.

Being able to anticipate these shifts and plan accordingly could help IT decision-makers create more resilient, secure, and scalable digital infrastructures that are capable of responding to evolving user needs and regulatory expectations.

Conclusion

The global OS landscape is undergoing shifts that reflect how people live, work, and adapt to technology. While Android and Windows continue to dominate their respective segments, other platforms like Huawei’s HarmonyOS are carving out more meaningful roles.

As organisations plan for the future, understanding these changes can help shape smarter procurement, development, and support strategies.

Whether you’re building a cross-platform app or sourcing devices for global teams, one thing’s clear: your OS choices are business-critical. Staying on top of market share trends can help your organisation stay informed and competitive.